By A Mystery Man Writer

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

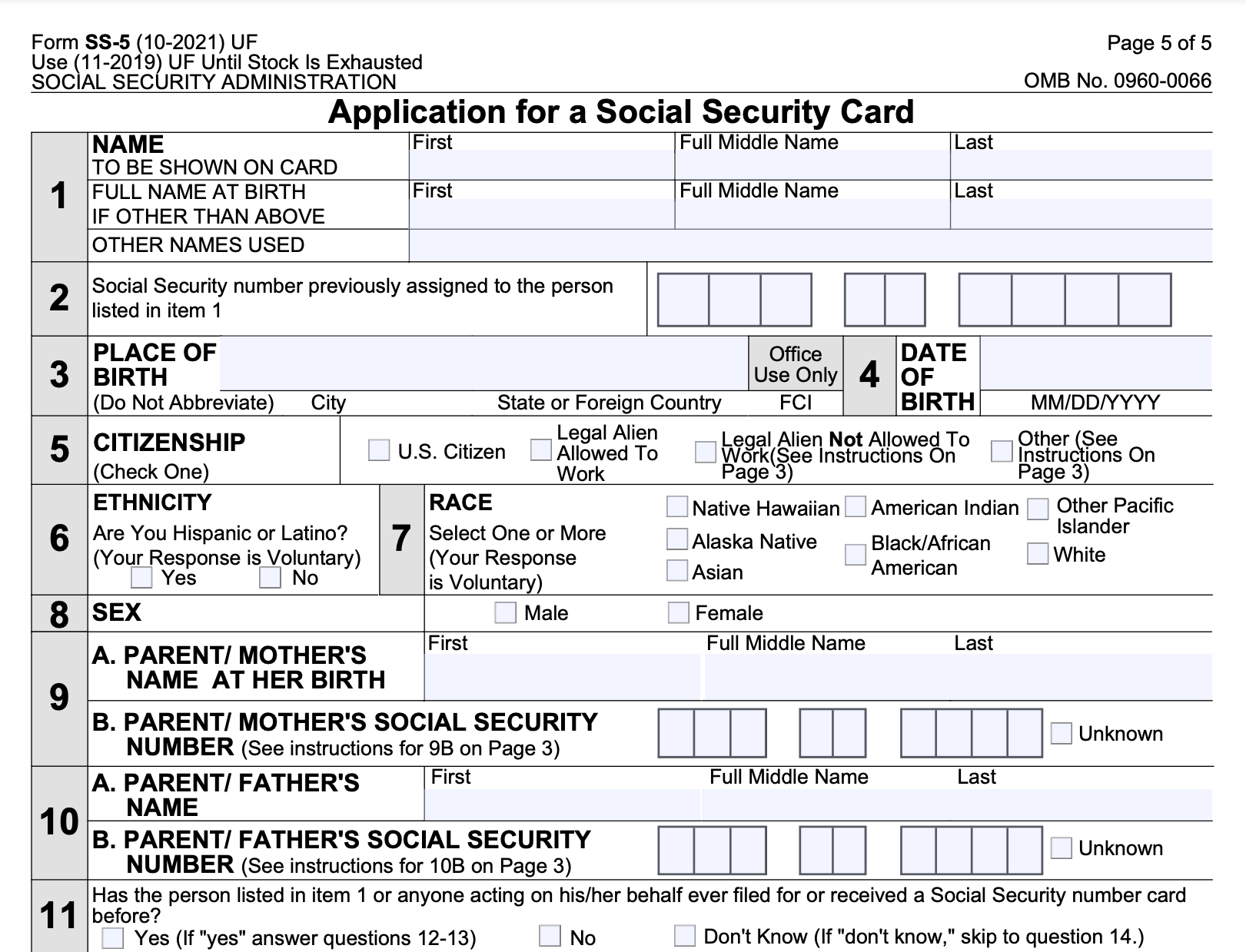

The Social Security tax, levied on both employers and employees, funds Social Security and is collected in the form of a payroll tax or a self-employment tax.

FICA Tax Refund Timeline - About 6 Months with Employer Letter and

What Is Social Security Tax? Definition, Exemptions, and Example

FICA Tax Refund Timeline - About 6 Months with Employer Letter and

FICA explained: Social Security and Medicare tax rates to know in

What Eliminating FICA Tax Means for Your Retirement, fica tax

What Is And How To Calculate FICA Taxes Explained, Social Security

Requesting FICA Tax Refunds For W2 Employees With Multiple

:max_bytes(150000):strip_icc()/GettyImages-144560286-5487bad3922545488c4e7f5d462ed0af.jpg)

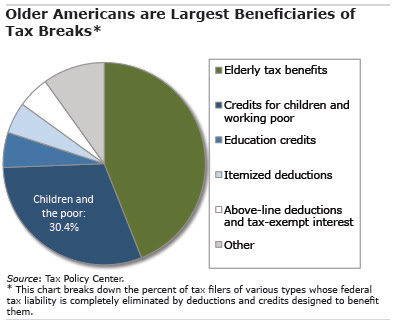

How Are Social Security Benefits Affected by Your Income?

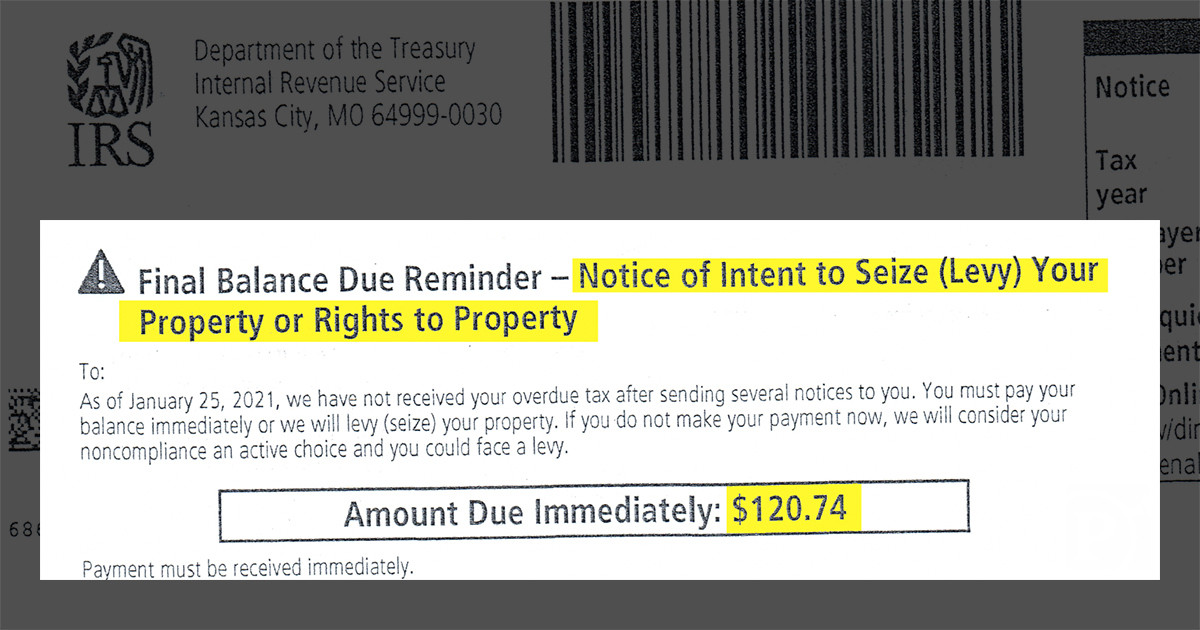

:max_bytes(150000):strip_icc()/mail-4b3c29eeac4d46118893c2bc1577459a.jpg)

FICA Tax Refund Timeline - About 6 Months with Employer Letter and

FICA Tax Refund Timeline - About 6 Months with Employer Letter and

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes on Earnings After Full Retirement Age