By A Mystery Man Writer

Generally speaking, we found that the likelihood of achieving expected returns is not simply a function of high multiples. In fact, it varies depending on risk profile. For direct investments, loss rates and holding periods play a significant role. For venture fund counterparts, the same holds true, but exit strategies – whether through IPO or M&A – and capital-deployment timing also matter a great deal.

Risk-return matrix for firms.

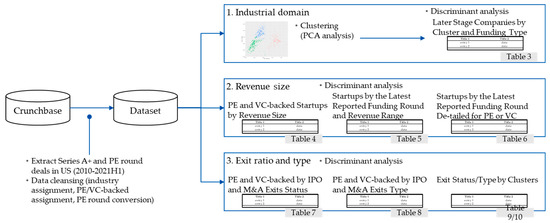

JRFM, Free Full-Text

In The Loop—Chapter 12: Justifying Transformation Investments, by Tom Mohr, CEO Quest Insights

Applying Decision Analysis to Venture Investing, Journal

Concept of Risk and Return (Including Capital Asset Pricing Model)

Solved Question 17 (1 point)Most small-business ventures

2022 Comprehensive Guide to Venture Capital Method

JRFM, Free Full-Text

27 levers to influence the investor perceived risk-return ratio for investments in early stage, radical

A Brief History of Venture Capital

How to Manage a VC Fund Unique.vc Learning Center

The risk and return of venture capital - ScienceDirect