Recently, Pakistan’s Appellate Tribunal Inland Revenue (ATIR second tier appeal forum) has allowed an appeal against the tax authority’s order for recovery of withholding tax

Coordinating Taxation Across Borders in: Fiscal Monitor, April 2022

Chapter 14 Formulary Apportionment in Theory and Practice in

Coordinating Taxation Across Borders in: Fiscal Monitor, April 2022

Ran artzi geneve 2013 presentation final

Administration of Double Tax Treaties

Coordinating Taxation Across Borders in: Fiscal Monitor, April 2022

Document

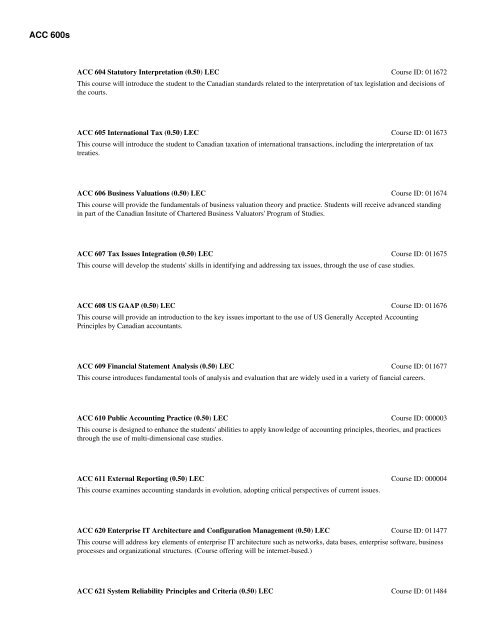

ACC 600s - Undergraduate Calendar - University of Waterloo

Local Content Policies in the Oil and Gas Sector by World Bank

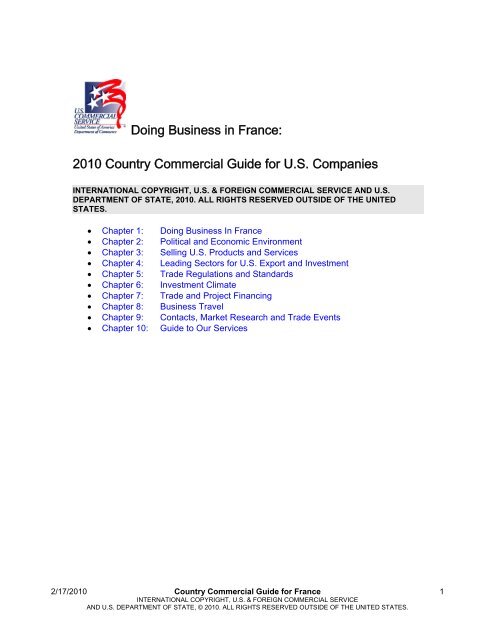

Doing Business In (Insert Country Name Here) - Department of